If you want a midsize loan and you've got good credit, Avant may very well be an answer. Avant only demands a credit rating score of 580. It's also possible to prequalify for a personal loan (which only requires a delicate credit history strike) to examine your eligibility.

The above mentioned calculator tab offers a caulator to quickly determine widespread Loan-to-Worth (LTV) quantities dependant on the value of your property & just how much you owe on the existing loan.

It’ll depend upon the lender, but most demand a credit history rating of at the very least 620 for your cash-out refinance.

LightStream doesn’t specify its precise credit rating score necessities, however , you need to have superior to exceptional credit rating to qualify.

With Rocket Loans, you gained’t have to worry about uploading your paperwork manually. This on the web lender verifies your identity, profits and bank account electronically. This might be amongst the reasons why it may possibly give very same-day loans.

The level of the bigger loan is predicated on your own equity degree, what you continue to owe in your present-day loan and the amount of in added resources you will need. Preferably, The brand new mortgage loan would also feature a lessen interest charge. How an FHA cash-out refinance is effective

Home loan calculatorDown payment calculatorHow A lot house am i able to manage calculatorClosing expenses calculatorCost of dwelling calculatorMortgage amortization calculatorRefinance calculator

Origination fee: The payment a lender expenses whenever you get the loan to cover processing and administrative costs.

Hospitals were given financial incentives to label deaths as staying attributable to COVID-19. Those people economic incentives as well as loose reporting of 'died with' vs 'died of' has prompted inflated Loss of life counts.

An FHA cash-out refinance allows you to borrow towards the fairness in your home without having to take 85 cash loan out a next home finance loan. An FHA cash-out refinance includes swapping out your existing house loan that has a new, larger sized just one. If a FHA cash-out refinance isn’t ideal for your money predicament, a house equity loan, HELOC or particular loan could possibly be a practical substitute.

With a cash-out refinance, you’ll pay off your existing home finance loan having a new, much larger loan and pocket the difference. Mortgage loan lenders commonly allow you to borrow as much as eighty% of your private home’s benefit with a standard cash-out refinance, this means you need to sustain at the very least twenty% fairness in your home.

When evaluating provides, make sure you overview the fiscal institution's Conditions and terms. Pre-capable presents are certainly not binding. If you find discrepancies together with your credit history rating or facts from your credit rating report, remember to Get in touch with TransUnion® directly.

The equity you've got constructed up in your house or financial commitment property is an extremely genuine asset that can be tapped to supply usage of ready cash if you need it. Having said that, like any economic enterprise, borrowing from that equity comes with specific challenges, chief amongst them a long run mortgage and the feasible forfeiture of one's collateral (ie your house). Whilst cash-out refinancing does offer brief use of cash, it is crucial to weigh every one of the advantages and disadvantages ahead of picking a whole new loan.

Card advice guideTravel benefits and perksEarn cash backPay down debtMake a major purchaseGet your approval odds

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Tatyana Ali Then & Now!

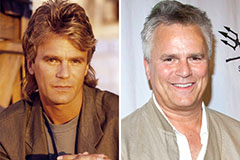

Tatyana Ali Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!